It’s no longer a secret only the top fashionistas know about: purchasing your high end Celine bag in a foreign country is an easy way to cut hundreds off your purchase price thanks to tax-refunds. But where exactly can you find the absolute best and highest tax-refund for your Celine bag? Where can you get the biggest bang for your buck? We’ve broken down ALL the details so you can spend less on that coveted bag you’ve been dreaming of.

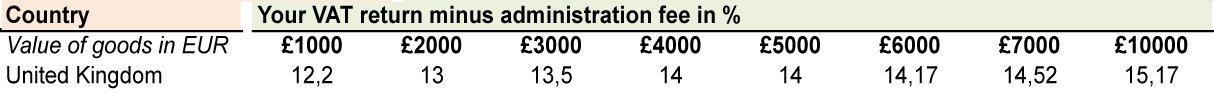

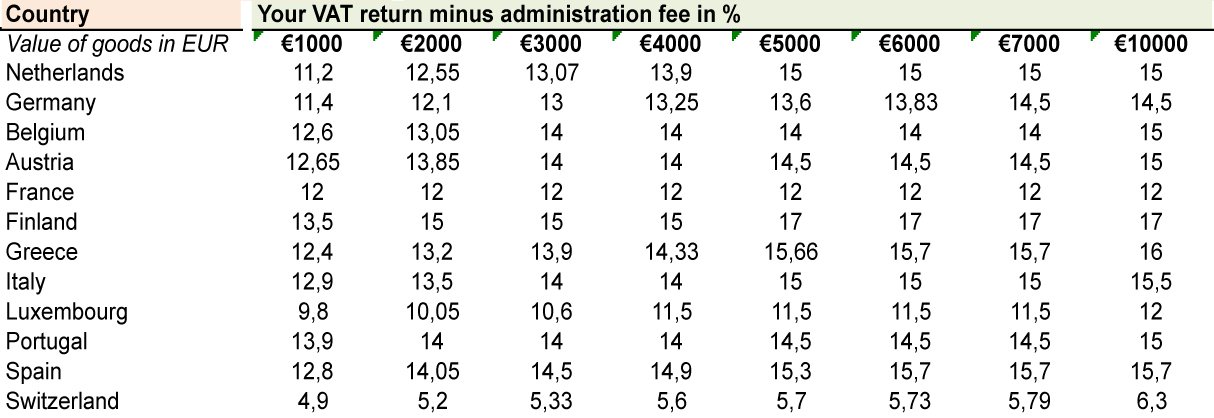

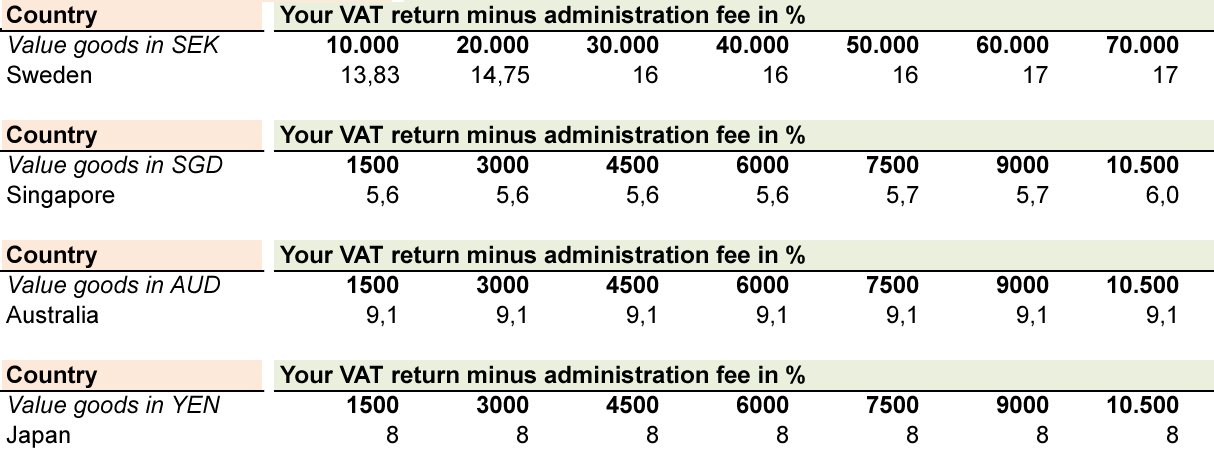

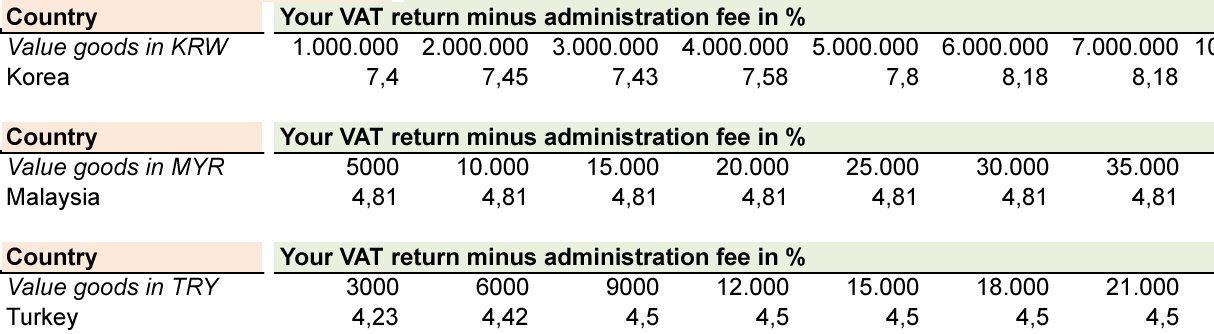

When it comes to how much of a tax-refund you will receive, the amount depends entirely on two factors: firstly, the value of the good you purchased will determine how much you are given back. As you may assume, the higher the value of your item, the more tax-refund you will receive. Secondly, each European country sets a different percentage of how much tax-refund you are able to receive. For example, in France the percentage is 20% while Switzerland is 8%; but that doesn’t necessarily mean you will receive that exact amount back.

How Tax-refunds Is Calculated

Let’s explain that in a little more detail. As you can see in our table, the United Kingdom has a 20% VAT on all purchases; however, you will not receive the entire 20%. It’s calculated like this:

100 euro + 20% = 120 euro, but 120 – 20% does not = 120.

Instead, 120 – 16.66% = 100 euro.

Tourists leaving the country with their expensive good will receive even less than this amount. Why, do you ask? Because tourists are required to apply for a tax-refund by an affiliate company. Most of these companies are located inside airports, making it a lot easier to apply before leaving the country. However, while these companies may make receiving your tax-refund a cinch, they will charge administration fees for their services, leaving you with even less of your refund.

Tax-refund Depends On The Country

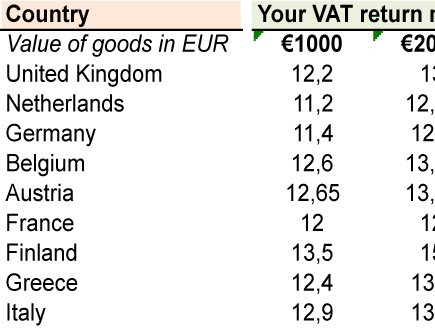

Always remember that each country will have a different VAT percentage, so keep that in mind when making your purchase and applying for your tax-refund. As of now, Russia does not have a tax-refund system. There were plans to introduce a system in the beginning of the year 2012, but plans never came to fruition. China is just starting to test out a tax-refund system in two cities, Beijing and Shanghai. For more information about VAT percentages per country, please see our handy table, where you will find a list of countries, their VAT percentage amount, and the VAT return for tourists with the inclusion of an administration cost.

So what happens when you travel to several countries and purchase goods in all of them? When do you apply for VAT, and what percentage will you receive? Well, let’s say you plan to arrive in Paris and travel to Amsterdam and London. You will APPLY for VAT in your last location, London. However, if you purchased the goods in Paris, you get the VAT AMOUNT for Paris, not London. This is because you have already paid the VAT amount in Paris, and will receive the refund for that specific amount. Affiliate companies (tax-refund companies) found in airports will help you get the right VAT amount returned.

Wondering HOW to go about getting your VAT refund? Here’s the process:

1. Purchase Your Goods

This is the fun part: picking out your DREAM Celine handbag and actually walking it up to the register for purchase; basically one of the most exciting times in a fashionistas life

2. Have Your Passport

You’ll have to prove you are a tourist before the refund process can begin, so have this document ready.

3. Receive the Right Documents

The merchant will need to create a tax-free form for your purchase. Ensure they complete this form and fill out ALL of the details.

4. Get Your Documents Stamped

When you’re ready to head back home, you’ll need to have your documents stamped at customs.

5. Get Your Refund

Find an affiliate company that will get you your refund. These refund services can easily be found inside the airport. Present your documents and they will typically be able to hand you a cash refund right then and there. If not, you should be credited to your credit card within two billing cycles. (Some companies may require you to mail in your documents, which may leave you waiting months for your refund).

It may seem like a big ordeal, but getting that tax-refund is imperative to saving hundreds on your Celine handbag purchase!

ALSO READ: The ultimate guide: Celine timeless bags >>

ALSO READ: Where to buy Celine bag the cheapest >>

ALSO READ: Celine bag prices >>

ALSO READ: Celine leather guide >>

ALSO READ: More news about Celine >>

Does anyone know what the VAT refund is after administration free in Ireland for Celine? Thanks!