One of the easiest ways to find your dream Hermes bag is to purchase it in a foreign country. Thanks to the refund other countries offer to tourists, you can knock off hundreds- if not thousands- off your purchase price. But where exactly can you find the best and highest tax-refund for your coveted Hermes bag? We’ve broken down all the must-know details so you can easily find the highest tax-refund for your perfect Hermes bag.

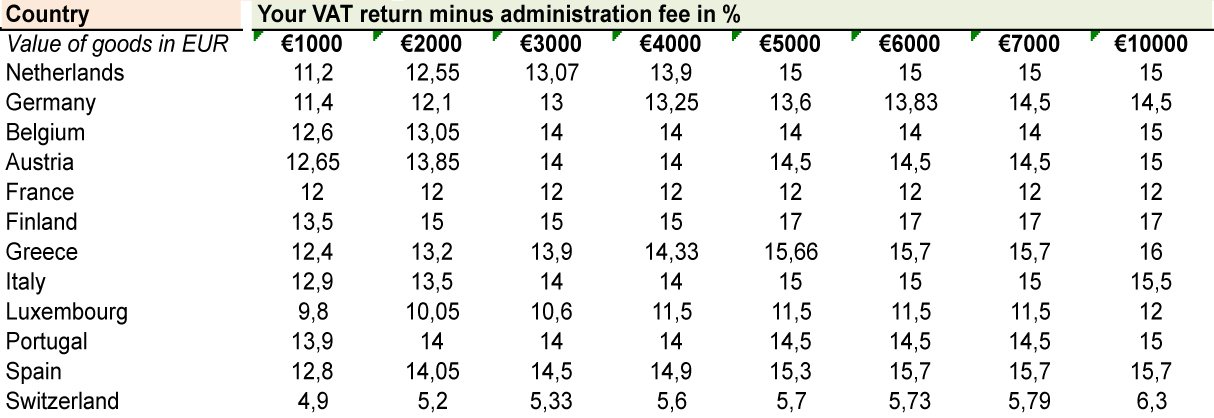

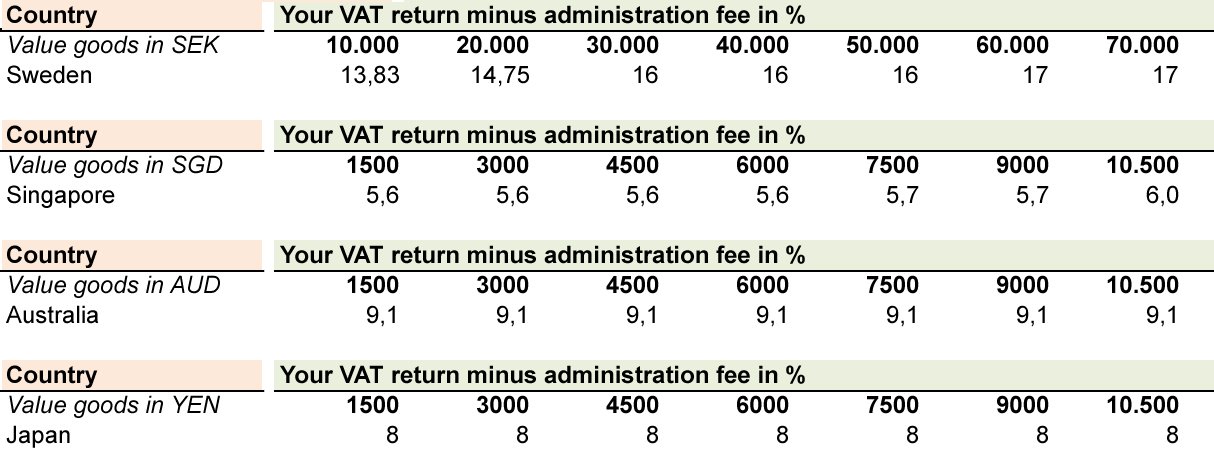

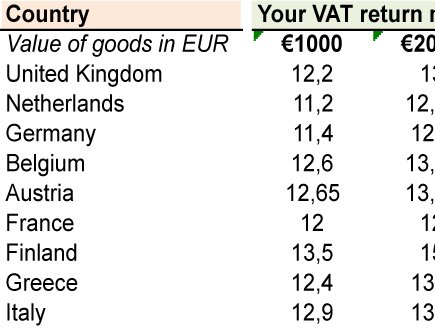

When it comes down to the amount of tax-refund you will receive, it simply depends on two different factors: firstly, the value of the good you purchased will determine how much you are given back; the higher the value of your item, the more tax-refund you will receive. Secondly, each European country offers a different tax-refund percentage amount. For example, in France the percentage is 20% while Switzerland is 8%; but that doesn’t necessarily mean you will receive that exact amount back.

How Tax-refunds Is Calculated

What does that mean? How much tax-refund will you actually receive? Let’s do the math: As you can see in our table, the United Kingdom has a 20% VAT on all purchases; however, you will not receive the entire 20%. It’s calculated like this:

100 euro + 20% = 120 euro, but 120 – 20% does not = 120.

Instead, 120 – 16.66% = 100 euro.

A tourist leaving the country with their high-end Hermes bag will receive even less than this. Why? Because tourists are required to apply for a tax-refund by an affiliate company, and they charge a fee for their services. Most of these companies are located inside airports, making it easy to apply for a refund before leaving the country. However, while these companies may make receiving your tax-refund quick and simple, they will charge administration fees for their services, leaving you with even less of your refund.

Tax-refund Depends On The Country

Always remember that each country will have a different VAT percentage, so keep that in mind when making your purchase and applying for your tax-refund. As of now, Russia does not have a tax-refund system. There were plans to introduce a system in the beginning of the year 2012, but plans never came to fruition. China is just starting to test out a tax-refund system in two cities, Beijing and Shanghai. For more information about VAT percentages per country, please see our handy table, where you will find a list of countries, their VAT percentage amount, and the VAT return for tourists with the inclusion of an administration cost.

So what happens when you travel to several countries and purchase goods in all of them? When do you apply for VAT, and what percentage will you receive? Well, let’s say you plan to arrive in Paris and travel to Amsterdam and London. You will APPLY for VAT in your last location, London. However, if you purchased the goods in Paris, you get the VAT AMOUNT for Paris, not London. This is because you have already paid the VAT amount in Paris, and will receive the refund for that specific amount. Affiliate companies (tax-refund companies) found in airports will help you get the right VAT amount returned.

Step By Step: The Tax-refund Process

Wondering HOW to go about getting your VAT refund? Here’s the process:

1. Purchase Your Goods

Pick out your Hermes bag at one of the stores and buy it.

2. Have Your Passport

You’ll have to prove you are a tourist before the refund process can begin, so have this document ready.

3. Receive the Right Documents

The merchant will need to create a tax-free form for your purchase. Ensure they complete this form and fill out ALL of the details.

4. Get Your Documents Stamped

When you’re ready to head back home, you’ll need to have your documents stamped at customs.

5. Get Your Refund

Find an affiliate company that will get you your refund. These refund services can easily be found inside the airport. Present your documents and they will typically be able to hand you a cash refund right then and there. If not, you should be credited to your credit card within two billing cycles. (Some companies may require you to mail in your documents, which may leave you waiting months for your refund).

ALSO READ: The ultimate guide: Hermes timeless bags >>

ALSO READ: Where to buy Hermes bag the cheapest >>

ALSO READ: Hermes leather guide >>

ALSO READ: Hermes bag prices >>

ALSO READ: More news about Hermes >>

Hi Alex. Thanks for your response.

It seems like they took back the VAT refund they gave me and charged it to my card. I don’t have the exact details yet since this is still under “unbilled transactions” and will come up once my credit card cut off is due.

This is very stranged, please keep us updated.

I was recently in Spain and bought several H bags plus other luxury items there. Availed of the tax refund downtown, had the forms stamped/scanned then put in the drop box prior to leaving the country. After a month, I saw that my credit card was charged by Global Blue for a single item. Don’t understand why since I complied with all the requirements. Would you happen to have an email address for them since their website does not specifically indicate that. Hope you can help me out.

Hi Martha, what did they charge u for? They should refund u and not charge? Here’s the form to contact their company:

https://secure.globalblue.com/customer-services/contact-us/#emailSection

Or you can also phone them, it’s quicker.