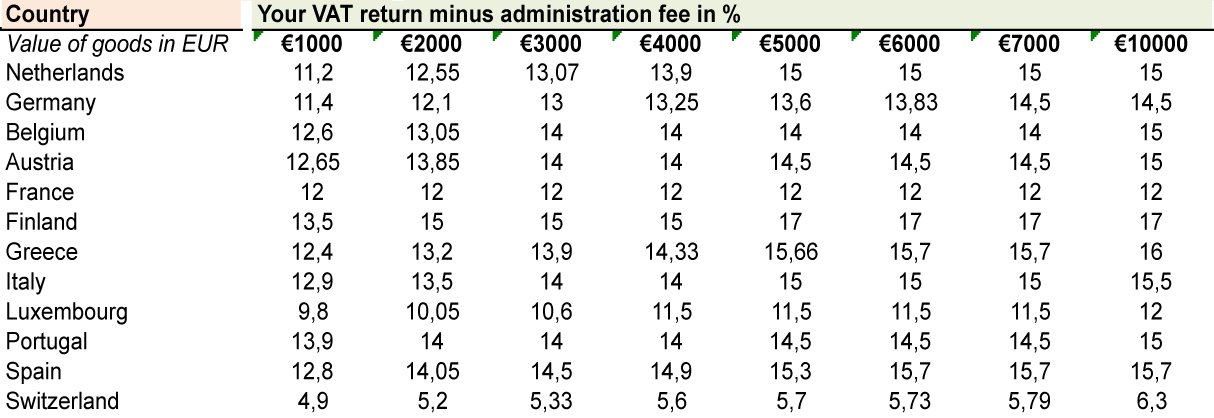

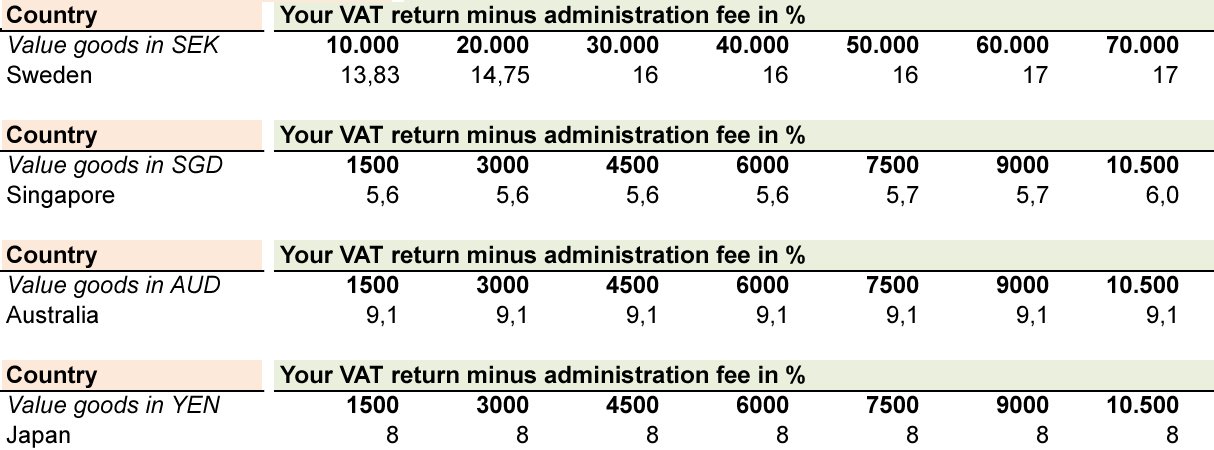

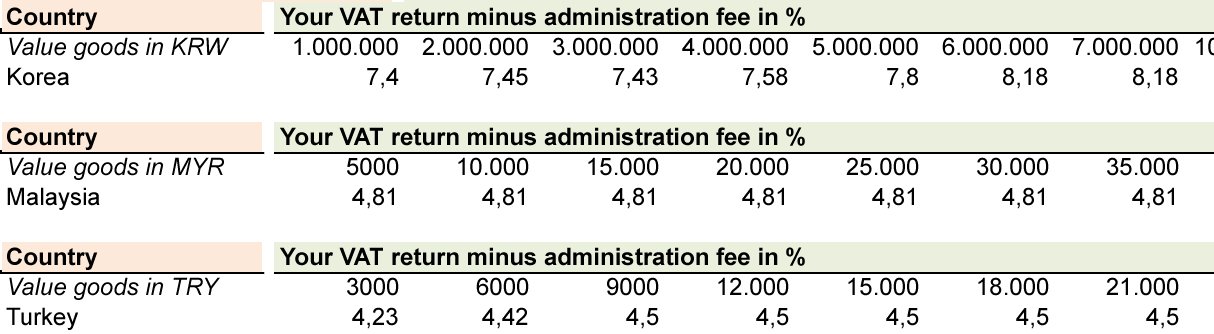

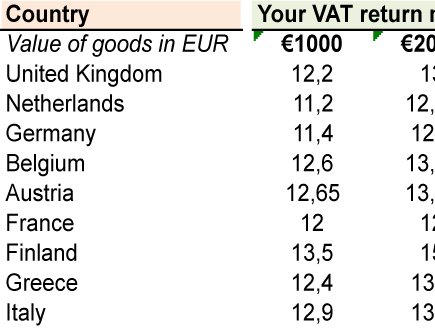

In search of your next coveted Chanel bag, it’s not uncommon to travel to another country to make your purchase. Why? Because you’ll get a tax-refund in other countries, which can cut hundreds off your purchase price. But what country offers the highest tax-refund for Chanel bags? Check out our handy table, which provides the VAT percentage amount for several countries along with the VAT amount after administration fees.

Taking a glance at our table you will notice one thing in particular: every European country has their own amount of VAT percentage. For example, the Netherlands offers a 21% tax-refund while Switzerland only offers an 8% tax-refund. The amount of the tax-refund will depend entirely on two things: the overall value of the goods being purchased and the country it is purchased in. As you may assume, the higher the value of the goods bought, the more tax-refund the consumer will receive.

How Tax-refunds Is Calculated

Now, pay close attention to how tax-refunds are calculated. Most individuals will assume that because a country, say the United Kingdom for instance, has a 20% VAT, that they will get 20% back from their purchase. But that’s not entirely true. It is calculated in this format: 100 Euro + 20% = 120 Euro, but 120 Euro – 20% does not = 120 Euro. Instead, 120 Euro – 16.66% = 100 Euro.

The tax-refund amount a tourist receives will be even lower after administration fees. You see, when you apply for your tax-refund in another country, you have to apply with an affiliate company. This company will help you get your tax-refund as soon as possible (sometimes immediately), but they will charge an administration fee for their services. These companies are typically located in the airports to make the process simpler, but this does mean ending with a lower tax-refund amount.

Tax-refund Depends On The Country

The tax-refund amount will be different in each country because the VAT percentage varies. And don’t think just because Dubai and Hong Kong are tax-free areas that your Chanel handbag will be cheaper; it all depends on the retail price. As for Russia, they had plans to introduce a tax-refund at the start of 2012, however these plans never came to fruition. China is just now starting to test out a tax-refund system in their Beijing and Shanghai cities.

A lot of people wonder how much refund they will receive and where they should file for a refund if they are traveling to several cities. Let’s say you will arrive in Paris, then travel to Amsterdam and London. You should apply for your tax-refund in your last stop, in this case being London. Your amount will depend on which country you purchased your items in. For instance, if you purchase your Chanel handbag in Paris and apply in London, you will get the tax-refund amount for Paris. Affiliate companies will help you process this information properly so you receive the right VAT percentage for your goods.

Step By Step: The Tax-refund Process

So how exactly does one go about acquiring their tax-refund?

1. Purchase Your Items.

Before you can get the refund, you have to buy something of course! This is definitely the fun part: finding your favorite Chanel dream bag and bringing it to the counter for purchase. Your only moments away from holding that Chanel bag and wearing it as your own!

2. Have Your Passport Ready

In order to get your tax-refund, you will need to prove that you are a tourist from another country. So make sure your passport is handy!

3. Receive Proper Documents from Retailer

The merchant will need to create a special tax-free form for your Chanel handbag purchase. After they fill out the document, glance it over to ensure all areas are completed.

4. Get Your Documents Stamped

Your document will need to be stamped at customs before you can apply and return home.

5. Get Your Refund

In order to get your tax-refund, you will need to get in contact with an affiliate company. These companies can easily be found inside of an airport. Present your documents to the company and they will typically hand you a cash refund. However, you may also have the tax-refund credited to your bank account, which takes about two billing cycles to complete. Some companies MAY require you to mail in your documents, which means you won’t see a refund for several months. (Most companies will pay cash immediately).

ALSO READ: The ultimate guide: Chanel timeless bags >>

ALSO READ: Where to buy Chanel bag the cheapest >>

ALSO READ: Chanel leather guide >>

ALSO READ: Chanel bag prices >>

ALSO READ: Chanel Classic Wallet Prices >>

ALSO READ: More news about Chanel >>

I have to express my appreciation to the writer just for bailing me out of this type of incident. Right after checking throughout the world-wide-web and obtaining methods which are not productive, I figured my entire life was well over. Living devoid of the approaches to the issues you’ve solved through your main report is a crucial case, as well as the ones which could have adversely damaged my entire career if I hadn’t come across your web page. Your skills and kindness in handling almost everything was important. I’m not sure what I would’ve done if I had not come across such a stuff like this. I can also at this point look forward to my future. Thanks a lot very much for your reliable and results-oriented guide. I won’t think twice to refer your web site to any person who ought to have recommendations on this area.